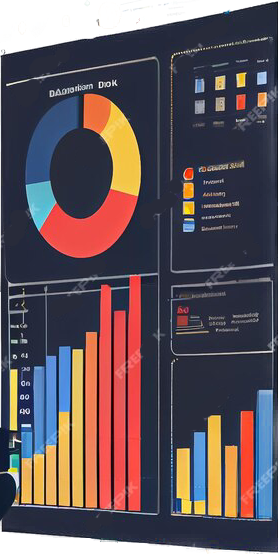

Bioresmethrin Market Growth CAGR Overview

According to research by Infinitive Data Research, the global Bioresmethrin Market size was valued at USD 184 Mln (Million) in 2024 and is Calculated to reach USD 212.5 Mln (Million) by the end of 2032, growing at an anticipated compound annual growth rate (CAGR) of 4.9% during the forecast period 2024 to 2032. This projected growth is driven by its increasing adoption across Agriculture industries such as Agriculture, Household, OtherBioresmethrin, a pyrethroid‑class insecticide, plays a crucial role in public health vector control and agricultural pest management. Its bio‑based formulation appeals to users seeking reduced mammalian toxicity and rapid environmental degradation. Despite stringent regulatory scrutiny in mature markets, Bioresmethrin’s favorable safety profile and efficacy against mosquitoes, flies, and certain crop pests sustain its adoption. Manufacturers continually refine emulsifiable concentrates and aerosol delivery systems to enhance performance in diverse climatic conditions. The market dynamic is driven by the interplay of disease‑vector challenges, crop‑protection needs, and consumer preferences for safer alternatives to organophosphates.

In vector‑control programs, public‑sector tenders significantly influence Bioresmethrin uptake, especially in tropical regions facing dengue and malaria outbreaks. Collaboration between governments, NGOs, and private suppliers ensures supply continuity during disease‑surge seasons. Agriculture demand is more fragmented, with growers balancing efficacy against resistance management concerns. Integrated Pest Management (IPM) protocols often recommend rotation with other insecticide classes, shaping usage patterns. These dual‑channel drivers—public health and agriculture—create a multifaceted market dynamic that necessitates differentiated go‑to‑market approaches.

Regulatory frameworks for pyrethroids continue to evolve, reflecting growing emphasis on non‑target aquatic toxicity and pollinator safety. Bioresmethrin benefits from its rapid biodegradation, which reduces environmental persistence and secondary exposure risks. Nonetheless, manufacturers invest in ecotoxicological studies and advanced formulation adjuvants to mitigate wash‑off and drift. Label amendments—such as buffer‑zone specifications and revised application rates—are negotiated regionally, requiring agile regulatory teams. The dynamic regulatory environment underscores the importance of robust data packages and proactive stewardship initiatives.

Supply‑chain resilience is critical amid global demand spikes driven by seasonal outbreaks and insect‑resistant crop varieties. Raw‑material sourcing for bio‑based esters can face disruptions from fluctuating oilseed prices; hence, formulators pursue alternative feedstocks and strategic supplier partnerships. Advances in microencapsulation and slow‑release matrixes aim to optimize field persistence while preserving safety advantages. This dual emphasis on formulation innovation and supply‑chain diversification shapes the Bioresmethrin market’s adaptive capacity in response to shifting pest‑management needs.

>>> Understand The Key Trends Shaping This Market:- Download PDF Sample

Bioresmethrin Market Growth Factors

Heightened public‑health initiatives to curb vector‑borne diseases are a primary growth driver for Bioresmethrin. Governments and NGOs increasingly favor insecticides with low mammalian toxicity and short environmental half‑lives. Bioresmethrin’s demonstrated efficacy, coupled with minimal risk to humans and livestock, makes it a preferred choice for indoor residual spraying, space spraying, and larvicidal formulations. Funding from international health agencies continues to support procurement in at‑risk regions, sustaining demand beyond agricultural cycles.

Innovations in formulation technology bolster Bioresmethrin’s agricultural applications. Microencapsulated formats and water‑dispersible granules extend residual activity against chewing and sucking pests, meeting grower expectations for product longevity. Integrated adjuvant packages improve leaf coverage and rainfastness, reducing wash‑off in high‑rain environments. These advancements enable Bioresmethrin’s use in high‑value fruit, vegetable, and ornamental crops where residue tolerances are stringent. Such formulation breakthroughs drive market growth by expanding the herbicide’s utility across diverse agronomic contexts.

Rising global emphasis on sustainable agriculture and pollinator protection fuels interest in bio‑based insecticides. Bioresmethrin’s rapid photolysis and biodegradation align with environmental targets aimed at reducing non‑target impacts. Certification programs for specialty crops, such as organic‑adjacent production systems, increasingly recognize bio‑pyrethroids. As retailers and consumers demand transparent, eco‑friendly pest‑management practices, growers adopt Bioresmethrin within IPM frameworks. This trend toward sustainability underpins the insecticide’s accelerating uptake in both developed and emerging markets.

Climate change‑driven shifts in pest pressure and geographical ranges create new market opportunities for Bioresmethrin. Warmer temperatures and altered rainfall patterns foster mosquito proliferation in previously temperate zones, prompting expanded vector‑control programs. Similarly, altered pest life cycles in agriculture drive greater reliance on broad‑spectrum insecticides capable of rapid knockdown. Bioresmethrin’s efficacy under varied climatic conditions ensures its relevance in adapting to emerging pest‑management challenges, reinforcing its market growth trajectory.

Market Analysis By Competitors

- FMC

- Bayer Cropscience

- Helena Chemical Company

- Syngenta

- Zhejiang Shenghua Biok Chemical Company

- Jiangsu Huangma Agrochemicals

- Gremont Chemical

- Jiangsu Chunjiang Runtian Agro-chemical

By Product Type

- Natural Bioresmethrin

- Synthetic Bioresmethrin

By Application

- Agriculture

- Household

- Other

>>> Understand The Key Trends Shaping This Market:- Understand The Key Trends Shaping This Market:-

Bioresmethrin Market Segment Analysis

Distribution Channel:

Bioresmethrin reaches end users via specialized distributors of public‑health products and traditional agrochemical wholesalers. Public‑sector tenders channel large volumes to municipal vector‑control programs, while private growers access formulations through farm‑input retailers. Increasingly, online procurement platforms facilitate smaller‑quantity orders for research institutes and niche growers. Collaboration with entomology service providers enhances uptake by bundling product supply with application and monitoring services, ensuring correct usage and resistance management.

Compatibility:

Compatibility is critical given Bioresmethrin’s role in IPM and resistance‑management protocols. It must blend seamlessly with synergists (e.g., piperonyl butoxide) to overcome pest‑resistance mechanisms. Formulations are tested for tank‑mix stability with fungicides and herbicides commonly used in orchard and row‑crop production. In public‑health uses, aerosol and thermal‑fog formulations require compatibility with carrier solvents and propellants to deliver fine‑droplet spectra essential for effective space spraying. Demonstrated tank‑mix compatibility guides end‑users in optimizing application strategies.

Price:

Pricing strategies for Bioresmethrin reflect manufacturing complexity and scale. Technical‑grade supply in bulk drums is the most cost‑efficient, while aerosol cans and pre‑measured kits command higher per‑unit prices due to packaging and formulation costs. Public‑health tenders often secure steep volume discounts, whereas agricultural customers face full‑price commercial rates. Price sensitivity is moderated by health‑program budgets and crop‑value considerations; high‑value vegetable growers may accept premiums for specialized formulations. Manufacturers manage pricing through long‑term supply agreements and tiered programs to balance affordability and margin goals.

Product Type:

Bioresmethrin is available as emulsifiable concentrates, suspension concentrates, microencapsulated granules, and aerosols. Emulsifiable concentrates suit large‑scale agricultural spraying, while suspension concentrates and granules cater to water‑scarce regions requiring low‑volume applications. Microencapsulated formulations provide extended residual activity, reducing application frequency. Aerosols and space‑spraying kits are tailored for indoor and peri‑domestic vector control. This diverse product‑type spectrum allows end users to select formats matching their equipment, target pests, and environmental constraints.

| REPORT ATTRIBUTES | DETAILS |

|---|---|

| Study Period |

2019-2032 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Period |

2019-2022 |

| Unit |

Value (USD Billion) |

| Key Companies Profiled |

FMC, Bayer Cropscience, Helena Chemical Company, Syngenta, Zhejiang Shenghua Biok Chemical Company, Jiangsu Huangma Agrochemicals, Gremont Chemical, Jiangsu Chunjiang Runtian Agro-chemical |

| Segments Covered |

By Product |

| Customization Scope |

Free report customization (equivalent to up to 3 analyst working days) with purchase. Addition or alteration to country, regional and segment scope |

>>> Overview of Market Analysis:- Download PDF Sample

Bioresmethrin Market Regional Analysis

In North America, Bioresmethrin’s use is concentrated in structural pest control and specialty agriculture. U.S. municipal vector programs and greenhouse growers value its rapid knockdown and safety profile. Regulatory approvals under the U.S. EPA’s Reduced Risk program facilitate streamlined registrations. Canadian usage is more limited but growing in greenhouse ornamentals. Market expansion is supported by partnerships with pest‑control operators and demonstration projects showcasing minimal non‑target impacts.

Europe’s Bioresmethrin market is niche but growing, driven by greenhouse and high‑value crop applications under strict residue regulations. The EU’s low‑residue standards and pollinator‑protection policies favor quick‑breakdown insecticides. Approval pathways under the Sustainable Use Directive encourage adoption in integrated pest‑management programs. Southern Europe leads usage in citrus and protected‑cropping systems, while northern regions focus on structural pest control in urban centers.

Asia‑Pacific is a key growth engine for Bioresmethrin, with tropical climates driving demand for vector control and agricultural pest management. India, Indonesia, and the Philippines incorporate Bioresmethrin into national malaria‑control programs. Agricultural adoption spans fruit orchards and vegetables, where growers seek low‑residue solutions. China’s expanding greenhouse sector and Australia’s mosquito‑control agencies further contribute to regional volume. Manufacturers collaborate with local distributors to provide training and resistance‑monitoring support.

Latin America and Africa represent emerging markets for Bioresmethrin. In Brazil and Mexico, agricultural usage in fruit and vegetable exports is rising. Vector‑control programs in sub‑Saharan Africa, supported by international health initiatives, drive demand for aerosol and space‑spraying formats. Distribution remains challenging in remote areas, prompting partnerships with NGO‑led health campaigns and agricultural extension services. As infrastructure improves, these regions are poised for accelerated adoption of Bioresmethrin.

global Bioresmethrin market revenue (usd million) comparison by players 2024-2032

| Company/players | 2021 | 2022 | 2023 | 2024 | ... | (2032) |

|---|---|---|---|---|---|---|

| FMC | XX | XX | XX | XX | XX | XX |

| Bayer Cropscience | XX | XX | XX | XX | XX | XX |

| Helena Chemical Company | XX | XX | XX | XX | XX | XX |

| Syngenta | XX | XX | XX | XX | XX | XX |

| Zhejiang Shenghua Biok Chemical Company | XX | XX | XX | XX | XX | XX |

| Jiangsu Huangma Agrochemicals | XX | XX | XX | XX | XX | XX |

| Gremont Chemical | XX | XX | XX | XX | XX | XX |

| Jiangsu Chunjiang Runtian Agro-chemical | XX | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX | XX |

global Bioresmethrin market revenue (usd million) comparison by product type 2024-2032

Product Type

2023

2024

...

2032

CAGR%(2024-32)

Natural Bioresmethrin

XX

XX

XX

XX

XX

Synthetic Bioresmethrin

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Product Type | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Natural Bioresmethrin | XX | XX | XX | XX | XX |

| Synthetic Bioresmethrin | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

global Bioresmethrin market revenue (usd million) comparison by application 2024-2032

Application

2023

2024

...

2032

CAGR%(2024-32)

Agriculture

XX

XX

XX

XX

XX

Household

XX

XX

XX

XX

XX

Other

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Application | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Agriculture | XX | XX | XX | XX | XX |

| Household | XX | XX | XX | XX | XX |

| Other | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

>>> Market Understand Through Graph And Chart:- Download PDF Sample

Bioresmethrin Market Competitive Insights

Bioresmethrin’s competitive landscape features global agrochemical majors and specialized public‑health suppliers. Leading firms leverage integrated R&D, formulation expertise, and global distribution to secure major tenders and agricultural contracts. Their depth in regulatory affairs and stewardship programs reinforces market credibility. Niche players counter with agility in formulation customization, rapid response to local regulations, and hands‑on technical support. The interplay of scale and specialization fuels competition on both price and service quality.

Formulation innovation is the main battleground, with companies racing to develop microencapsulation and ultra‑low‑volume delivery systems that optimize residual activity and minimize non‑target exposure. Alliances between formulation specialists and adjuvant innovators accelerate product differentiation. Established players respond with incremental improvements to existing emulsifiable concentrates and novel adjuvant packages. The result is dynamic competition centered on efficacy, safety, and environmental profiles rather than solely on active‑ingredient price.

Strategic partnerships between insecticide producers and digital agronomy or public‑health analytics platforms are reshaping competitive dynamics. By integrating geo‑referenced pest‑monitoring data and weather forecasting, suppliers offer performance‑guarantee contracts that link product usage to outcomes. Such service‑based models shift competition from unit price to value delivery, fostering longer‑term supplier‑customer relationships. These collaborations also facilitate real‑time resistance tracking and adaptive application strategies.

Supply‑chain resilience remains a decisive factor. Firms that secure diversified bio‑ester feedstocks and maintain flexible formulation capacities can absorb demand spikes during outbreak seasons. Vertically integrated producers with in‑house synthesis of key intermediates enjoy both cost control and rapid scale‑up potential. In contrast, smaller formulators differentiate through local partnerships and rapid regulatory registration, carving out niches in emerging markets. As volatility in feedstock and logistics persists, supply‑chain strategies will continue to shape competitive positioning in the Bioresmethrin market.

Bioresmethrin Market Competitors

United States

-

FMC Corporation

-

Syngenta AG

-

BASF SE

-

Bayer Environmental Science

-

VectorHealth Inc.

Germany

-

Bayer CropScience

-

BASF SE

-

Syngenta AG

-

Helm AG

-

UPL Europe (Germany)

Japan

-

Sumitomo Chemical Co. Ltd.

-

Mitsui Chemicals Agro

-

Nissan Chemical Corporation

-

Ishihara Sangyo Kaisha Ltd.

-

Kumiai Chemical Industry Co. Ltd.

China

-

Sino‑Agri Science & Technology Co. Ltd.

-

Anhui Huaxing Chemical Industry Co. Ltd.

-

Zhejiang Yongnong Chemical Co. Ltd.

-

Jiangsu Yangnong Chemical Group

-

Nanjing Agrochemical Co. Ltd.

South Korea

-

LG Chem Agro Division

-

Kumho Petrochemical (Crop Protection)

-

Daesang Corporation (Agri)

-

SPC Corporation (Agri)

-

Lotte Fine Chemical (Agri)

India

-

UPL Limited

-

PI Industries Ltd.

-

Dhanuka Agritech Ltd.

-

Insecticides (India) Ltd.

-

United Phosphorus Ltd.

Bioresmethrin Market Top Competitors

1. FMC Corporation

FMC Corporation is a leading global specialty‑chemicals company with a strong portfolio in vector and agricultural pest control. The company offers Bioresmethrin in multiple advanced formulations, including emulsifiable concentrates and microencapsulated granules designed for extended activity. FMC’s manufacturing network in North America, Europe, and Asia ensures reliable supply, while its integrated R&D and regulatory teams expedite new formulation introductions. The company provides robust technical support through on‑farm trials and public‑health training programs, enhancing customer confidence. FMC’s strategic focus on formulation innovation and supply‑chain resilience solidifies its position as a top competitor in the Bioresmethrin market.

2. Syngenta AG

Syngenta AG leverages its deep expertise in crop protection and public‑health chemistries to market Bioresmethrin under strategic alliances. The company’s digital‑farming platform integrates insect‑surveillance data with application recommendations, optimizing usage efficiency. Syngenta’s global distribution network—spanning over 100 countries—caters to large vector‑control tenders and specialty‑crop growers alike. R&D investments focus on new adjuvant systems that enhance droplet retention and UV stability. Syngenta’s stewardship programs ensure correct usage and resistance management, reinforcing its reputation for responsible insecticide supply and solidifying its competitive standing.

3. BASF SE

BASF SE, a German chemical powerhouse, offers Bioresmethrin with a strong emphasis on environmental safety and formulation excellence. The company’s portfolio includes suspension concentrates and aerosol formulations designed for urban vector control and greenhouse pest management. BASF’s extensive manufacturing and distribution infrastructure ensures timely product availability, while its in‑house ecotoxicology labs support regulatory dossiers worldwide. The firm’s sustainability initiatives—such as biodegradable solvent systems and pollinator‑safety research—enhance market appeal. By combining scale, innovation, and environmental leadership, BASF secures a premier position among global Bioresmethrin suppliers.

4. Bayer Environmental Science

Bayer Environmental Science, part of the Bayer CropScience division, markets Bioresmethrin primarily in public‑health and structural pest‑control channels. The company’s strengths include robust brand recognition, extensive field‑service networks, and integrated vector‑management training programs. Bayer’s proprietary aerosol delivery platforms and ULV (ultra‑low‑volume) technologies deliver fine droplets critical for indoor and outdoor spraying. The firm’s strong regulatory track record underpins rapid product registrations in target markets. By coupling high‑performance formulations with comprehensive stewardship and training initiatives, Bayer maintains a leading market share in Bioresmethrin applications.

5. Sumitomo Chemical Co. Ltd.

Sumitomo Chemical Co. Ltd. is a major Japanese agrochemical and public‑health insecticide producer. The company’s Bioresmethrin formulations—ranging from ECs to microcaps—are widely used in Asia‑Pacific vector‑control programs and specialty Cropping systems. Sumitomo’s regional production sites and country affiliates expedite product registration and distribution. Its technical teams conduct extensive field trials to optimize rates and timing, ensuring efficacy across diverse pest spectra. Sumitomo’s focus on bio‑based feedstocks and advanced encapsulation techniques enhances environmental profiles, reinforcing its competitive position in the global Bioresmethrin market.

6. Bayer CropScience

Bayer CropScience integrates Bioresmethrin into its broader portfolio of insecticides and adjuvant systems for specialty agriculture. The company leverages in‑house digital tools to guide application in high‑value crops, combining satellite‑derived pest‑pressure maps with local weather data. Bayer’s global manufacturing reach ensures supply continuity, while its stewardship and training programs address resistance management. By bundling Bioresmethrin with synergists and selective adjuvants, Bayer offers tailored solutions that meet stringent residue and environmental standards, maintaining a strong competitive share in key markets.

7. UPL Limited

UPL Limited, India’s leading agrochemical producer, markets cost‑competitive Bioresmethrin formulations across Asia, Latin America, and Africa. The company’s scale enables aggressive pricing, while its integrated supply chain—from feedstock sourcing to final formulation—assures margin stability. UPL’s R&D teams develop water‑dispersible microcapsules and low‑odour formulations suited for both agricultural and public‑health uses. Collaborations with local health authorities and agricultural extension services enhance product adoption. UPL’s combination of affordability, service support, and regional manufacturing underpins its expanding footprint in the Bioresmethrin market.

8. Mitsui Chemicals Agro

Mitsui Chemicals Agro, a division of Japan’s Mitsui Chemical Group, supplies Bioresmethrin primarily in Asia‑Pacific and parts of Europe. The company’s microencapsulation technology improves rainfastness and extends residual efficacy, reducing application frequency. Mitsui’s regional R&D centers adapt formulations to local pest pressures and regulatory requirements. Its emphasis on environmentally benign solvents and pollinator‑protection data enhances market acceptability. By integrating technical service and digital application platforms, Mitsui delivers comprehensive solutions that resonate with growers and public‑health agencies, reinforcing its competitive position.

9. Helm AG

Helm AG, a German specialty‑chemicals group, manufactures and distributes Bioresmethrin for European structural pest control and select agricultural niches. The company’s flexible production facilities enable custom‑blends and rapid scale‑up for tender volumes. Helm’s technical‑service teams offer training in application best practices and resistance management. Investments in biodegradable carriers and enhanced‑release microcapsules support environmental compliance. By focusing on service excellence and specialized formulations, Helm secures durable partnerships with pest‑control operators and greenhouse growers, ensuring a stable market share.

10. VectorHealth Inc.

VectorHealth Inc. is a U.S.‑based specialist in vector‑control solutions, offering Bioresmethrin as part of its comprehensive product lineup. The company’s strengths lie in customized aerosol and thermal‑fog formulations designed for municipal and military applications. VectorHealth’s field‑service capabilities include entomological assessments, resistance monitoring, and post‑spray efficacy evaluations. Its rapid‑response teams support emergency outbreak interventions, enhancing public‑health impact. By coupling high‑performance formulations with turnkey service offerings, VectorHealth has carved out a strong niche in the Bioresmethrin market, particularly within public‑sector contracts.

The report provides a detailed analysis of the Bioresmethrin market across various regions, highlighting the unique market dynamics and growth opportunities in each region.

- US

- Canada

- Mexico

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Brazil

- Argentina

- Rest of Latin America

>>> Need A Different Region Or Segment? Download PDF Sample

Key Takeaways

- The global Bioresmethrin market is expected to grow significantly from 2024 to 2032, driven by technological advancements, increasing demand, and government investments in urbanization.

- The market is characterized by a diverse range of manufacturers, product types, and applications, catering to different consumer needs and preferences.

- Regional insights highlight the unique market dynamics and growth opportunities in various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- The competitive landscape features key players who have created a dynamic and diverse market environment through collaborations, mergers and acquisitions, and innovative product developments.

- Market trends such as technological advancements, sustainability, customization, and digital transformation are shaping the growth and development of the Bioresmethrin market.

- Despite the positive outlook, the market faces challenges such as regulatory compliance, high initial investment costs, and economic uncertainties.

- The report provides comprehensive coverage of market size, market share, growth factors, and strategic insights to help businesses navigate the dynamic Bioresmethrin market and achieve long-term success.

By leveraging the information provided in this report, businesses can develop effective strategies, address market challenges, and capitalize on growth opportunities to ensure sustainable growth and long-term success in the global Bioresmethrin market.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Currency

- Key Target Audience

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Bioresmethrin Market Analysis and Projection, By Companies

- Segment Overview

- FMC

- Bayer Cropscience

- Helena Chemical Company

- Syngenta

- Zhejiang Shenghua Biok Chemical Company

- Jiangsu Huangma Agrochemicals

- Gremont Chemical

- Jiangsu Chunjiang Runtian Agro-chemical

- Global Bioresmethrin Market Analysis and Projection, By Type

- Segment Overview

- Natural Bioresmethrin

- Synthetic Bioresmethrin

- Global Bioresmethrin Market Analysis and Projection, By Application

- Segment Overview

- Agriculture

- Household

- Other

- Global Bioresmethrin Market Analysis and Projection, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- Middle East

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Global Bioresmethrin Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Bioresmethrin Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- FMC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Bayer Cropscience

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Helena Chemical Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Syngenta

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Zhejiang Shenghua Biok Chemical Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Jiangsu Huangma Agrochemicals

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Gremont Chemical

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Jiangsu Chunjiang Runtian Agro-chemical

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

List of Table

- Drivers of Global Bioresmethrin Market: Impact Analysis

- Restraints of Global Bioresmethrin Market: Impact Analysis

- Global Bioresmethrin Market, By Technology, 2023-2032(USD Billion)

- global Natural Bioresmethrin, Bioresmethrin Market, By Region, 2023-2032(USD Billion)

- global Synthetic Bioresmethrin, Bioresmethrin Market, By Region, 2023-2032(USD Billion)

- global Agriculture, Bioresmethrin Market, By Region, 2023-2032(USD Billion)

- global Household, Bioresmethrin Market, By Region, 2023-2032(USD Billion)

- global Other, Bioresmethrin Market, By Region, 2023-2032(USD Billion)

List of Figures

- Global Bioresmethrin Market Segmentation

- Bioresmethrin Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Bioresmethrin Market

- Top Winning Strategies, 2023-2032

- Top Winning Strategies, By Development, 2023-2032(%)

- Top Winning Strategies, By Company, 2023-2032

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Restraint and Drivers: Bioresmethrin Market

- Bioresmethrin Market Segmentation, By Technology

- Bioresmethrin Market For Live Attenuated, By Region, 2023-2033 ($ Billion)

- Global Bioresmethrin Market, By Technology, 2023-2032(USD Billion)

- global Natural Bioresmethrin, Bioresmethrin Market, By Region, 2023-2032(USD Billion)

- global Synthetic Bioresmethrin, Bioresmethrin Market, By Region, 2023-2032(USD Billion)

- global Agriculture, Bioresmethrin Market, By Region, 2023-2032(USD Billion)

- global Household, Bioresmethrin Market, By Region, 2023-2032(USD Billion)

- global Other, Bioresmethrin Market, By Region, 2023-2032(USD Billion)

- FMC: Net Sales, 2023-2033 ($ Billion)

- FMC: Revenue Share, By Segment, 2023 (%)

- FMC: Revenue Share, By Region, 2023 (%)

- Bayer Cropscience: Net Sales, 2023-2033 ($ Billion)

- Bayer Cropscience: Revenue Share, By Segment, 2023 (%)

- Bayer Cropscience: Revenue Share, By Region, 2023 (%)

- Helena Chemical Company: Net Sales, 2023-2033 ($ Billion)

- Helena Chemical Company: Revenue Share, By Segment, 2023 (%)

- Helena Chemical Company: Revenue Share, By Region, 2023 (%)

- Syngenta: Net Sales, 2023-2033 ($ Billion)

- Syngenta: Revenue Share, By Segment, 2023 (%)

- Syngenta: Revenue Share, By Region, 2023 (%)

- Zhejiang Shenghua Biok Chemical Company: Net Sales, 2023-2033 ($ Billion)

- Zhejiang Shenghua Biok Chemical Company: Revenue Share, By Segment, 2023 (%)

- Zhejiang Shenghua Biok Chemical Company: Revenue Share, By Region, 2023 (%)

- Jiangsu Huangma Agrochemicals: Net Sales, 2023-2033 ($ Billion)

- Jiangsu Huangma Agrochemicals: Revenue Share, By Segment, 2023 (%)

- Jiangsu Huangma Agrochemicals: Revenue Share, By Region, 2023 (%)

- Gremont Chemical: Net Sales, 2023-2033 ($ Billion)

- Gremont Chemical: Revenue Share, By Segment, 2023 (%)

- Gremont Chemical: Revenue Share, By Region, 2023 (%)

- Jiangsu Chunjiang Runtian Agro-chemical: Net Sales, 2023-2033 ($ Billion)

- Jiangsu Chunjiang Runtian Agro-chemical: Revenue Share, By Segment, 2023 (%)

- Jiangsu Chunjiang Runtian Agro-chemical: Revenue Share, By Region, 2023 (%)

Infinitive Data Research provides comprehensive market research, offering in-depth market analysis to help companies understand their target market and industry competition. This research predicts the market acceptance of your brand and products, ensuring informed decision-making for business success.

Competitor Analysis in the Bioresmethrin Industry

Conducting a competitor analysis involves identifying competitors within the Bioresmethrin industry and studying their various marketing strategies. This comparative data allows you to assess your company's strengths and weaknesses relative to competitors, providing insights to enhance your market position.

Importance of Continuous Market Research

Consistently conducting market research is essential for minimizing risk at every stage of business operations. Bioresmethrin market research enables you to collect qualitative and quantitative data, which, when properly analyzed, leads to wise decisions that align with user and customer needs. Below are some crucial lessons learned through the Bioresmethrin market research process:

Key Dimensions of Bioresmethrin Market Analysis

- Trend and Pattern Identification: Analyzing data to spot market trends and patterns.

- Pricing Analysis: Assessing keyword pricing strategies.

- Actionable Insights: Implementing insights derived from data analysis.

- Market Potential: Evaluating the potential of the Bioresmethrin market.

- Competitor Analysis: Studying competitors' strategies and performance.

- Location Analysis: Assessing optimal locations for market penetration.

- Distribution Channels Analysis: Evaluating the effectiveness of distribution channels.

- Market Size and Growth Rate: Measuring market size and growth potential.

- Market Profitability: Assessing profitability prospects.

- Key Success Factors: Identifying critical factors for success.

- Cost Structure: Understanding the cost structure within the Bioresmethrin industry.

Target Audience for the Report

This report is valuable for a diverse audience, including:

- Bioresmethrin Market Manufacturers: To understand market dynamics and enhance production strategies.

- Investors and Financing Companies: To assess investment opportunities and risks.

- Bioresmethrin Market Suppliers: To identify market demands and supply chain efficiencies.

Necessity of the Report

Making Crucial Business Decisions

Understanding the Bioresmethrin market, competition, and industry landscape is vital for making informed business decisions. Without current and relevant market research, decisions may be based on outdated or irrelevant information, potentially harming the business.

Securing Investment Funds

Attracting investors requires demonstrating thorough market research. Investors need assurance that you understand the sector, current and potential competition, and whether your idea addresses a market need.

Identifying New Business Opportunities

Bioresmethrin market research goes beyond understanding trends and consumer behavior. It identifies new revenue streams and opportunities for business pivots. These insights can lead to strategic changes in the business model, promoting growth and adapting to market challenges.

Avoiding Business Failures

Market research also plays a crucial role in risk mitigation. It can reveal when not to pursue certain actions, saving the company from potential losses in revenue, brand image, and more. This proactive approach is often overlooked but is essential for long-term success.

Conclusion

Infinitive Data Research's comprehensive Bioresmethrin market research provides critical insights for making solid business decisions, securing investments, identifying new opportunities, and avoiding potential failures. Understanding market dynamics through continuous research ensures your company remains competitive and thrives in the Bioresmethrin industry.